Individual Tax Series: Tradespersons' Deductions: Eligibility, Reporting, and Maximizing Your Tax Savings

- Rylan Kaliel

- Jun 16, 2025

- 13 min read

Updated: Jun 20, 2025

For tradespeople in Canada, the cost of purchasing and maintaining essential tools and travelling to temporary work locations can be substantial. Fortunately, the Canada Revenue Agency (CRA) provides specific tax deductions to help offset these expenses.

Understanding eligibility requirements, what expenses qualify, and how to accurately claim these deductions can lead to significant tax savings. This blog post provides comprehensive insights into the tradespersons' tools deduction, the eligible apprentice mechanic tools deduction, and the Labour Mobility Deduction.

Tradespersons’ Tools Deduction

The tradespersons’ tools deduction provides a deduction for the cost of eligible tools in the year these tools were purchased. The below will go through the main points of making this deduction, however, please review the CRA’s website for additional information.

Who Can Claim the Tradespersons' Tools Deduction?

You may qualify for the tradespersons' tools deduction if you:

Work as an employed tradesperson (e.g., electrician, plumber, mechanic, carpenter, etc.)

Purchase eligible tools required for your employment

Have your employer certify that the tools purchased are necessary for your job on Form T2200 Declaration of Conditions of Employment

For greater certainty, a tradesperson is a very broad definition and would include a person engaged in trading or a trade. This person does not need to be registered to be considered a tradesperson. If taken loosely, the thought process is only a tradesperson would ordinary be required by their employers to purchase tools for use in their work, so this may result in the interpretation being extremely broad. It is recommended that prior to claiming this deduction, you discuss whether or not you may be considered a tradesperson with a tax professional.

Please also note that this deduction is for employed tradespersons. Where you are a self-employed tradesperson different rules apply to you.

Eligible Tools

Eligible tools include items that:

You purchased specifically for use in your job.

Your employer certified it as being necessary for your job.

It was not used for any purpose before you bought it (i.e., it was a new).

It is not an electronic communication device (i.e., cell phone) or electronic data processing equipment (i.e., computer).

You were not reimbursed by your employer.

Tools that qualify must typically have a useful life beyond one year, including power tools, hand tools, electronic diagnostic equipment, and specialized protective gear.

Calculating the Tradespersons' Tools Deduction

The deduction is calculated by subtracting the annual threshold amount ($1,433) from the total cost of eligible tools purchased during the year. The difference is the amount you can claim as a deduction, up to a maximum set annually by the CRA. This deduction cannot exceed $1,000 in a year.

The actual formula for this deduction is as follows:

Lessor of:

$1,000; and

The amount determined by the formula:

A - $1,433

where

A is the lessor of:

The total cost of eligible tools purchased in the year

Your income from employment as a tradeperson for the year, plus any specific grants received, minus any overpayments received from these grantsLet’s look at a simple example, where eligible tools purchased in the year was $3,000 and income, inclusive of any grants, was $56,000.

As we can see in the above, the majority of the calculations is comparing the tool cost to income from employer, of which the tool cost is lower for $3,000. Afterwards, we reduce this deduction for the annual limit of $1,433, to get a value of $1,567. Given we cannot deduct more than $1,000, we are required to deduct $1,000 at most.

As noted above in Who Can Claim the Tradespersons' Tools Deduction? this deduction is for employed tradespersons. If you are self-employed, you will typically not be restricted on the amount that you can deduct, either from the upper limit of $1,000 or the lower limit of $1,433 (for 2024, adjusted annually). See our Self-Employment Deduction blog for more details.

Calculating the Income for a Tradesperson on the Disposition of Tools

When you dispose of your tools, you may be required to include an amount into income. To calculate the amount of income you must report, we would first need to determine what the adjusted cost base (ACB) of the specific tool was (see our Capital Gains blog on additional discussion on ACB). The ACB can be determined through the following formula:

D – (D x [E/A])

where

D is the original cost of the tool you disposed of

E is the total of the tradespersons’ tool deduction you claimed in the year that the disposed of tool was purchased

A is the total cost of each eligible tool you bought in the year that the disposed of tool was purchased.Let’s look at an example, let’s say that the disposed of tool cost $700, the deduction claimed in that year was $1,000, and the total cost of all eligible tools purchased in the year was $4,000. We would calculate our ACB as follows:

As we can see, the ACB, for tax purposes, is less than the original cost. The rationale is that if we got a deduction for the tool, we should reduce the ACB of the tool for amounts previously deducted. This deduction is done in proportion to all tools purchased in that year. As the deduction was 25% ($1,000 (E) / $4,000 (A)) of the tool costs, then the cost of the tool should be reduced by 25%, or $175 ($700 * 25%), for a revised ACB of $525 ($700 - $175).

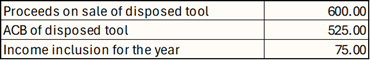

Once we have determined the ACB of the tool, we would then calculate the income. This calculation is simply the proceeds on the sale of the tool less the ACB. Let’s assume the proceeds was $600. Following from the previous example, we would expect the following amount of income.

As can be seen above, we would have a $75 income inclusion in the year on the disposition of the tool. Please note, there is no deduction if the proceeds on sale of the disposed tool are less than that tools ACB. Instead, you will not be required to report anything.

Further, as noted above in Who Can Claim the Tradespersons' Tools Deduction? this income inclusion is for employed tradespersons. If you are self-employed, you will typically not be prevented from claiming a deduction. See our Self-Employment Deduction blog for more details.

Reporting Tradespersons' Tools Deductions

The tradespersons' tools deduction is claimed using Form T777 Statement of Employment Expenses. You must also have Form T2200 completed and signed by your employer, confirming that the tools purchased are necessary for your employment. Where you dispose of a tool and have income on this disposition, you would report this on line 13000 Other income on the T1 Income Tax and Benefit Return.

Eligible Apprentice Mechanic Tools Deduction

The eligible apprentice mechanic tools deduction provides an additional deduction, beyond the tradespersons’ tools deduction, for the cost of eligible tools in the year these tools were purchased. The below will go through the main points of making this deduction, however, please review the CRA’s website for additional information.

Who Can Claim the Eligible Apprentice Mechanic Tools Deduction?

In addition to being a tradesperson, if you are also an eligible apprentice mechanic, you may be able to deduct additional amounts for the cost of your tools. You may qualify for the eligible apprentice mechanic tools deduction if you:

You are registered in a program established under the laws of Canada or a province or territory that leads to a designation under those laws as a mechanic licensed to repair self-propelled motorized vehicles (i.e., automobiles, aircraft, boats, or snowmobiles).

You are employed as an apprentice mechanic.

Have your employer certify that the tools purchased are necessary for your job on Form T2200 Declaration of Conditions of Employment

You have first calculated the tradespersons’ tool deduction.

Eligible Tools

Eligible tools include items that:

You purchased specifically for use in your job.

Your employer certified it as being necessary for your job.

It was not used for any purpose before you bought it (i.e., it was a new).

It is not an electronic communication device (i.e., cell phone) or electronic data processing equipment (i.e., computer).

You were not reimbursed by your employer.

Calculating the Eligible Apprentice Mechanic Tools Deduction

The deduction is a little more complicated then the tradespersons’ tools deduction, in that it is limited to the lower of the cost of the tools or the greater of $1,000 plus the Canada employment amount (maximum of $1,433, adjusted annually) or 5% of your employment income, plus certain grants, less overpayments of grants (similar to the tradespersons’ tools deduction discussed in Calculating the Tradespersons' Tools Deduction). The actual deduction would be the cost of your tools less these amounts. Interestingly, you can carry forward undeducted tools in the prior year.

The actual formula for this deduction is determined through the following formula:

(A – B) + C

where

A is the total cost of eligible tools bought in the year

B is the lessor of:

The total cost of eligible tools you bought in the year (same as A)

The greater of

$1,000 plus the Canada employment amount claimed (maximum of $1,433)

5% of your income from employment as a tradeperson for the year, plus any specific grants received, minus any overpayments received from these grants

C is the amount, if any, of the maximum deduction for eligible tools calculated in the previous year that you did not claim in the previous yearAs a note for element B, specifically, the income from employment. This is net of other deductions against this employment, including the tradespersons’ tools deduction. For element C, this is the amount that you could have deducted but decided not to. Meaning that if you had a maximum deduction of $2,000 available, after all the calculations were complete, but only deducted $1,200, you would have $800 for element C. You can deduct these amounts in the following year as a carry forward, even if you are no longer employed as an eligible apprentice mechanic in the following year.

Let’s look at a simple example, where eligible tools bought in the year are $5,000, you receive the full Canada employment amount ($1,433), you have income, after deductions and inclusive of grants, of $56,000, and the previous years maximum deduction you did not claim in the previous year was $800.

As we can see, we take our total cost of tools ($5,000) bought in the year and would then be required to reduce this for several factors. The main calculation here is the $1,000 plus the Canadian employment amount claimed or 5% of income from employment as a tradesperson, whichever is greater ($2,800). We would then compare this amount to the cost of tools and take the lower amount ($2,800). Finally, we add any undeducted amounts from the prior year ($800) to determine our maximum deduction ($3,000).

Calculating the Income for an Eligible Apprentice Mechanic on the Disposition of Tools

The calculation of income on the disposition of tools for an eligible mechanic is very similar to that of a tradesperson, which was discussed in Calculating the Income for a Tradesperson on the Disposition of Tools. The key difference is that you must account for both the deduction for tradespersons’ tools and eligible apprentice mechanic tools in the calculation of the ACB.

To revisit this, let’s assume that the disposed of tool cost $700, the deduction claimed in that year was $1,000 for tradespersons’ tools and $3,000 for eligible apprentice mechanic tools. The total cost of all eligible tools purchased in the year was $5,000.

As we can see, the ACB, for tax purposes, is still less than the original cost. As was discussed in Calculating the Income for a Tradesperson on the Disposition of Tools, this is due to this reduction to the ACB for amounts previously deducted. This deduction is done in proportion to the cost of the tool, such that the reduction is 80% ($4,000 (E) / $5,000 (A)) and therefore the reduction to the cost of the tool is $560 ($700 * 80%), for a revised ACB of $140 ($700 - $560).

If the tool is sold for $600, then the income would be calculated simply as follows:

Please review Calculating the Income for a Tradesperson on the Disposition of Tools above for a more detailed explanation of how this calculation works. Similar to as is noted in this section, if you are self-employed, you will typically not be prevented from claiming a deduction. See our Self-Employment Deduction blog for more details.

Reporting Eligible Apprentice Mechanic Tools Deductions

The eligible apprentice mechanic tools deduction is claimed using Form T777 Statement of Employment Expenses. You must also have Form T2200 completed and signed by your employer, confirming that the tools purchased are necessary for your employment. Where you dispose of a tool and have income on this disposition, you would report this on line 13000 Other income on the T1 Income Tax and Benefit Return.

Labour Mobility Deduction

Another deduction that is available to tradespersons is the Labour Mobility Deduction. This deduction from a high-level provides a deduction for eligible temporary relocation expenses per year of up to the lower of:

50% of income from construction activities at the eligible temporary work location in the year; or

$4,000.

This deduction requires that you be an:

Eligible tradesperson

Had an eligible temporary relocation

Incurred eligible temporary relocation expenses

These will be discussed in more detail below, however, see the CRA’s website under “Labour Mobility Deduction (for eligible tradespeople)” for more details.

Eligible Tradesperson

For purposes of this deduction, an eligible tradesperson is a tradesperson or apprentice who:

Has income from employment

Performs their duties of employment in construction activities.

For purposes of defining construction activities, these generally include erection, excavation, installation, alteration, modification, repair, improvement, demolition, destruction, dismantling, or removal of all or any part of a building, structure, surface, or sub-surface construction or similar property. This thus includes a very broad array of construction activities. If you are concerned as to whether you meet these requirements, it is advised you discuss them with a tax professional.

Eligible Temporary Relocation

An eligible temporary relocation must meet all the following conditions to be met:

Relocation is undertaken to perform employment duties at one or more temporary work locations.

Prior to this relocation, the person ordinarily resided at a residence in Canada.

The person was required to be away from where they ordinarily resided for at least 36 hours.

During this period, the person took up temporary lodging in Canada.

The temporary lodging was at least 150 kilometres closer to each temporary work location then where the person currently resides.

A temporary work location is a location in Canada that is:

Where the person performs their employment duties under a temporary employment contract

Outside of the same locality, such as a city, where the person is ordinarily employed or carries on a business.

This deduction is calculated separately for each eligible temporary relocation, which means you may have multiple deductions for this if you have multiple eligible temporary relocations. The 150 kilometre-test will need to be satisfied for each temporary work location.

Eligible Temporary Relocation Expenses

An eligible temporary relocation expense is a reasonable expense incurred in the prior year, current year, or prior to February 1 of the following year for:

Temporary lodging if the person maintains their ordinary residence as their principal place of residence and this residence remains available for them to live in and is not rented to any other person (i.e., person has a home they can return to at any time and is not renting the home while they are in the temporary lodging).

Transportation for one round trip between the temporary work location and their home.

Meals consumed by the person during the round trip between their home and the temporary lodging. Please note that it is not confirmed that the simplified method can be used for these meals, so retain receipts so you can determine the amounts you actually incurred to calculate this deduction (see our Moving Expenses blog for details on the detailed and simplified method).

This deduction can be made for the periods noted above, provided the expense was not:

Deducted in a prior year

Otherwise deducted from the individual’s income for any tax year, such as a moving expense deduction (see our Moving Expense blog for more details).

An expense for which the person is entitled to receive a reimbursement, allowance, or any other form of assistance.

Essentially, provided the deduction was not already made and the person received no amounts to help support the costs, these amounts should be deductible up to $4,000. Note that if the expenses exceed the $4,000, the excess amount can be retained as a carry forward and may be deductible in the following year.

Calculating the Labour Mobility Deduction

Let’s assume that a person meets the definition of eligible tradesperson and has an eligible temporary relocation. This person retained there home and did not rent it out. This person earned $15,000 from the eligible temporary work location. They incurred $500 of travel expenses to and from the site, $600 of meals expenses during the trip to the site, and $3,500 lodging expenses at the site. They had undeducted amounts from this site of $500 from the previous year. No amounts are otherwise deducted, and no reimbursement, allowance, or other form of assistance are provided.

In the above, we first determine what our limit on our deduction is, that is, either 50% of the income from the site or the upper limit of $4,000. Afterwards, we calculate our total eligible temporary relocation expenses, which sums to $5,100. Given $5,100 is greater than our limit of $4,000, we only deduct $4,000. The remainder of $1,100 is deductible in the following year, if it does not go over the following years limit.

Similar to as is noted in Calculating the Income for a Tradesperson on the Disposition of Tools, if you are self-employed, you will typically not be prevented from claiming a deduction, nor will you generally be limited to the amount of deduction you may claim. See our Self-Employment Deduction blog for more details.

Reporting the Labour Mobility Deduction

The labour mobility deduction is claimed using Form T777 Statement of Employment Expenses. You will be required to report the worksite, expenses, and employment income earned at this location in the year. Ensure you track any undeducted amounts from the prior year to include in your tax return.

Documentation and Record-Keeping Requirements

Accurate record-keeping is essential for claiming this deduction successfully. Documentation should include:

Tools Deductions

Receipts clearly showing the date, description, and cost of each tool or expense.

Form T2200 provided by your employer.

Detailed records tracking tool expenses throughout the year.

Labour Mobility Deduction

Receipts clearly showing the date, description, and cost incurred.

Details showing the distance between your home and the temporary lodging and your home and the temporary work location.

Evidence you are required to be away from where you lived for at least 36 hours.

Common Mistakes and How to Avoid Them

Common pitfalls include:

Claiming tools or expenses not directly related to your employment or a temporary relocation.

Forgetting to account for employer reimbursements, which are not deductible.

Poor record-keeping and missing receipts.

To avoid these issues:

Clearly distinguish between personal and employment-related tool purchases or expenses related to a temporary relocation.

Maintain thorough and organized records and receipts.

Regularly review your records and documentation for accuracy.

Strategic Considerations to Maximize Deductions

Maximizing your deductions involves:

Strategically timing your tool purchases and expenses related to temporary relocations to maximize annual deductions.

Ensuring your employer provides the required Form T2200 each year.

Regularly reviewing eligible tools and expenses for temporary relocations and updating records accordingly.

Impact on Other Tax Credits and Benefits

Claiming the tradespersons' tools deduction, eligible apprentice mechanic tools deduction, and Labour Mobility Deduction can lower your net income, potentially increasing eligibility for other benefits and credits like the Canada Workers Benefit (CWB) or GST/HST credit.

Summary

Tradespersons' tools deductions, eligible apprentice mechanic tools deduction, and the Labour Mobility Deduction represent valuable tax savings opportunities for Canadian tradespeople. Understanding eligibility criteria, accurately calculating deductions, diligent record-keeping, and strategic purchasing can optimize your financial outcomes.

Stay tuned for our next blog, where we'll explore the Lifetime Capital Gains Exemption (LCGE) and its strategic tax planning benefits.

KLV Accounting, a Calgary-based accounting firm, is here to help. Contact us today to enhance your financial strategy, minimize your taxes, and drive business success! For a free consultation, call us at 403-679-3772 or email us at info@klvaccounting.ca.

.png)

Comments