Individual Tax Series: Carrying Charges and Interest Expenses: Understanding and Maximizing Your Deductions

- Rylan Kaliel

- Jun 11, 2025

- 21 min read

Updated: Jun 20, 2025

Carrying charges and interest expenses represent deductible costs that taxpayers can use to reduce their taxable income, particularly those related to investments. Understanding which carrying charges and interest expenses are eligible for deductions, and how to accurately report them, can substantially improve your overall financial and tax outcomes. This blog post clarifies eligible deductions, provides guidelines for accurate reporting, and offers strategic advice for maximizing these deductions.

What are Carrying Charges and Interest Expenses?

Carrying charges are costs incurred primarily for earning investment income, however, they can occasionally relate to other types of income. They often relate to managing your investment portfolio, maintaining your investments, or financing investment activities.

Interest expense often arises for both business and investment income but can occasionally arise for other types of income. These often relate to amounts borrowed to purchase investments, fund purchases of rental or other investment properties, to acquire equipment for your business, or other similar activities.

This blog will primarily focus on business and investment income; however, it is important to note that there may also be deductions for other types of income. As such, it would be prudent to discuss any interest expense you have with a tax professional to determine its deductibility.

Deductible Expenses

Before we get too deep into the details of these expenses, we should talk a bit about what is a deductible expense. In many cases, deductible expenses are quite straightforward, such as a travel for work and self-employment or union dues, where there is a clear line that indicates that these are deductible. When we discuss carrying charges and interest expenses, there can be some grey area and understanding how to navigate this grey area can help you understand how to orient your affairs to maximize your expenses.

We will discuss a few of the main considerations that should be accounted for with any expense. Each of these considerations can be tricky to navigate and as such we would advise that you discuss your expenses with a tax professional to ensure you are getting the best tax treatment out of them.

Personal versus Business and Investment Expenses

One of the main grey areas we will deal with is whether something is a personal expense, or if it is a business or investment expense. Where something is a personal expense, these amounts are generally not deductible, whereas business or investment expenses are typically deductible. Generally speaking, personal versus business or investment type expenses can be defined as follows:

Personal expenses: An expenditure incurred that provides a benefit for personal purposes only, such as lunch, movie tickets, etc.

Business or investment expenses: An expenditure incurred that provides a benefit for purposes of earning business or investment income, such as commissions on trading stocks, advertising, etc.

The key in determining what type of expense you have is identifying what the purpose of the expense is. For many situations, this can be very simple, such as advertising for a business generally doesn’t have a purpose component, you’re not getting something out of it other than to try to earn business or investment income. In some cases, this can be a grey area such as attending a conference in a resort where a portion of the time will be spent sitting by the pool and another portion in technical sessions or networking events.

When navigating these grey areas we need to think about what are all of the components of the specific expense. Let’s take a simple example, our taxpayer works as a renovation expert and goes to a local hardware store to purchase supplies, which include light fixtures and paint, but also sees that they need some light switches for their own home and purchases these on the same receipt. In this case, it is clear what is related to their business and personal, the personal component is only the light switches, whereas the other costs are business related. Our taxpayer in this case would be able to deduct everything except for the light switches, as they are personal expenditures.

Let’s move on to a more complicated example which exists in a very grey area. An actor incurs costs related to a nutritionist, personal trainer, and gym membership fees. The actor is required to obtain and maintain their physical appearance for purposes of their role in an upcoming show. This is a requirement of their business and failing to do so would result in them not being cast for the role and not earning business income. On this surface, this is an obvious business expense, so why do these costs regularly get denied and treated as personal?

The argument against these types of cases is that this actor gets some degree or personal satisfaction out of having this physical appearance. They get to look good and should enjoy the benefits, personally, from these costs. Given this, despite the requirement that they look a specific way for these roles, these costs can be routinely denied as they consider there to be a significant personal component.

These types of costs can be tricky, especially in some cases where the taxpayer doesn’t appreciate the personal benefit that is obtained from these costs. Sticking to the actor example, consider Dave Bautista, who through WWE and many roles was an extremely built and muscular man, but, at the time of writing, had trimmed down. They were rumoured to have trimmed down so they feel lighter and to be a more versatile actor. Should Dave Bautista be eligible to deduct those previous costs related to getting into a muscular shape as it was primarily for their role and they didn’t get satisfaction out of it? These are some of the grey areas we must deal with when considering personal versus business or investment expenses.

When it comes to correctly classifying these expenses, we must take a serious look at the situation and the facts that surround them. It can also be extremely important that we document the intention behind these expenses to support any questions or challenges posed by the CRA for these expenses.

Ancillary Expenses

In a similar vein as personal expenses, we should consider expenses that are ancillary to business or investment income. To illustrate this, consider the example of education expenses of a self-employed person. Where the person’s role is in insurance sales, a course of insurance is directly related to their business and would likely be deductible. However, what is they took a course on personal finance. This is not directly related to their role in insurance, however, understanding personal finance may result in them being better able to understand their client’s situation and assist them with the appropriate insurance. Often times these are also deductible.

These types of costs are commonly referred to as ancillary expenses and can be tricky to manage. The first is whether the ancillary expense contains a personal component, in which case we would have to review this considering what is personal and what isn’t. The second is, despite it not being directly related to the role, does it benefit the person in earning income from their business or investments?

Ancillary expenses can be tricky and should be treated similarly to personal versus business or investment expenses, reviewing the situation and facts carefully and determining if these are deductible.

Tracing of Funds

While this will be discussed in more detail in Direct Use, we should discuss this briefly in the context of deductible expenses. The source of the expenditure can help support the ability to deduct these expenses.

Take for example the cost of trading stocks, if these funds come directly from the investment account versus if the funds were paid out of a personal bank account. If the cost comes directly from the investment account, an account that is specifically setup to earn investment income, there is a clear link and use between the source of funds and the cost incurred. If it came from a personal account, there could be some questions as to why amounts coming out of a personal account are deductible as an investment expense.

While the above is a simple example, it does illustrate the need for support. The cost of trading stocks will almost never be denied, however, expenses that are in a grey area, such as those potentially containing a personal component, may benefit from having the expense come from a business or investment account to assist in legitimizing the expense.

Limitations of the Income Tax Act

Despite the above, some expenses may not be deductible or may have limitations to their deductibility solely as a result of specific provisions of the Income Tax Act (Canada). As a primary example, expenses related to meals and entertainment are only deductible at a rate of 50%, as a result of a specific provision of the Income Tax Act (Canada) that determines this. Further, financing fees incurred on taking out a loan are typically not deductible immediately, instead they are deducted evenly over five years.

It is important to understand these limitations on expenses as they could result in surprises come tax time. While discussing all the potential limitations are out of the scope of this blog series, it is recommended that you review our individual blog posts for a specific expense you are trying to review to ensure you understand any limitations that may arise.

Capital Property

Capital property was discussed previously in our Capital Gains blog, however, this is an important consideration for carrying charges and interest expense, so we will recap this here. Capital property is generally an asset that is held for longer periods of time, normally intended to be held for the benefits the asset can provide you during the time they are held. While our Capital Gains blog discussed what capital property was when you purchase the capital property, this blog will dive deeper into whether certain carrying charges or interest expense should be also treated as capital property.

Certain expenses may be treated as capital property. While a full accounting of what expense should be treated as capital property would be out of the scope of this blog, we will discuss the general consideration for whether an expense should be treated as capital property for carrying charges and interest expense.

The main consideration for these types of expenses is around the acquisition of the property, such as whether the expense was required to acquire the property. We understand that capital property requires that it be held for longer periods of time and intended to be held for the benefits the asset can provide, so those expenses that are required to acquire an asset of this type may be treated as capital property as well.

Take for example, the purchase of a significant number of shares in a company. There may be legal, commissions, or other types of expenses that relate to the acquisition of this property. These expenses are required to acquire a capital property and as such could be treated as capital property as well. The argument here is whether the expense provides a lasting benefit.

The lasting benefit argument is one of the main considerations for whether an expense should be treated as capital property. To review this consideration for your expenses, ask yourself, am I incurring an expense for something that will be around for a long time and/or improve the value of an asset that I treat as capital property (also known as a “capital expense”), or is it intended to only provide benefits for a short period of time (also known as a ”current expense”).

The downside of an expense being treated as capital expense is that it is not deductible in the current year. Instead, these expenses are added to the cost of the capital property and only technically deductible when the capital property is sold.

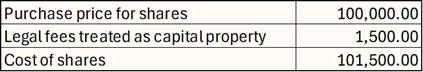

Let’s look at an example of this. A person is investing in a company, to which they are paying $100,000 for the shares. As part of this acquisition, they personally incur $1,500 of legal fees to deal with the subscription of the shares. We would calculate the acquisition of these shares as follows.

As we can see above, the legal fees increase the cost of the shares from $100,000 to $101,500. The legal fees cannot be deducted as an expense in the year, instead when they are eventually sold. The eventual sale of the asset will be calculated as a capital gain or loss, see our Capital Gain blog for details of this calculation.

On the actual sale of the asset, there may be similar costs incurred, which you may see in our Capital Gain blog are treated as selling expenses. These selling expenses are very similar, in that while they are deductible in the year they are incurred, they are deducted against the proceeds of capital property, which is only taxed at 50% (rate on capital gains or losses as at the time of writing). Technically, these selling expenses are also capital expenses, as they are not 100% deductible.

There can be several other situations that arise where these expenses are treated as capital expenses, even where an asset is not acquired. For example, costs incurred to acquire a corporation where the acquisition doesn’t actually arise may be treated as capital expenses but instead included as depreciable property (typically Class 14.1) and deducted over a number of years.

There are also situations where certain expenses that could be viewed as capital expenses, however, the courts have ruled these are still deductible or certain provisions in the Income Tax Act (Canada) have deemed these to be treated as current expenses. For an extremely thorough discussion, and for our more nerdy readers, consider the case of Rio Tinto v. the Queen, a particularly famous case on expenses incurred on the costs incurred in the acquisition of a corporation.

Types of Eligible Carrying Charges

Eligible carrying charges typically include:

Investment Management Fees: Fees paid to financial advisors or portfolio managers for managing investments.

Safe Deposit Box Fees: Costs for storing investment certificates or other income-producing documents.

Accounting and Legal Fees: Costs associated with preparing investment-related tax filings and associated legal costs relating to collecting income.

Interest Expenses: Interest paid on money borrowed to invest in income-producing assets such as stocks, bonds, or real estate.

Investment Management Fees: What’s Deductible?

Investment management fees are typically deductible on investments that are to earn investment income. These can include fees paid to financial advisors, portfolio managers, or other similar expenses.

Where care should be taken is on the type of investment account you are incurring these costs on. For example, investment management fees paid to manage investments in a RRSP or TFSA are typically not deductible, as technically they are tax-free income and thus no real income is earned. In comparison, a non-registered account that generates income on your return would typically have these expenses as being deductible. See our RRSP Contributions blog for a discussion of RRSP and non-registered accounts.

Safe Deposit Box Fees: What’s Deductible?

Fees incurred for a safe deposit box can be deductible provided they are incurred to store income-producing assets. The most common examples would include investment certificates or other similar documents, but could also include collectible coins, gold, or other assets the intent to which is to sell later for a profit.

Often we see persons including a combination of personal and business or investment related documents in a single safe deposit box. As was discussed in Personal versus Business and Investment Expenses, this can be tricky, as it becomes a question whether this should be treated as personal, business or investment, or a combination of both.

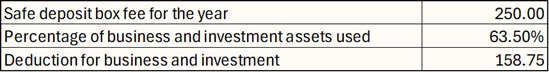

In many cases you could treat these very similar to how a home office would be treated (see our Home Office Expenses blog for more detail). You would consider how many items are in the safe deposit box or how much space it takes up. From there you would calculate the proportion of business and investment assets make up the safe deposit box and deduct this proportion. Let’s look at an example of this.

As we can see in the above example, if our usage of the safe deposit box is 63.50% for business and investment assets, then we would get a deduction of $158.75 out of the total $250.00 cost. The remaining portion would relate to the personal portion and would be non-deductible.

Accounting and Legal Fees: What’s Deductible?

Accounting and legal fees can generally be deducted where they are incurred for purposes of earning income. For purposes of explaining these further, we will separate out accounting and legal fees.

Accounting Fees

Accounting fees typically include bookkeeping fees for managing your business or investments, tax returns, consulting, and other activities. In the context of carrying charges, these often relate to fees incurred to manage and report on your investments, such as monthly, quarterly, and yearly reporting on the investments performance, year-end tax returns, and other similar activities.

Accounting fees are typically deductible against the business or investment income earned. Interestingly, tax returns are also typically deductible, despite them not always being deductible if you do not earn business or investment income. Given this, sometimes it can be beneficial to have some amount of business or investment income to enable you to deduct the tax return. Caution should be exercised in deducting these amounts, as a very nominal amount of business or investment income may not be enough to enable the deduction of a tax return.

Legal Fees

Legal fees typically include lawyer fees for a variety of activities, such as purchase and sale documents, drafting and finalization of contracts, incorporation, maintenance of a corporation, and other similar activities. In the context of carrying charges, they are more likely related to purchase and sale documents, incorporation, and maintenance of a corporation.

Legal fees can be treated as deductible, but they should be reviewed in the context of whether they should be treated as a capital expense (see Capital Property above for more details). Legal fees that are more common to be treated as deductible immediately and as a current expense are those incurred on a purchase or sale document for an asset that is not considered to be capital property.

Interest Expenses: What's Deductible?

Interest expenses are one of the most complicated expenses to deduct. While they can seem very straight forward, there is a lot to know about how to correctly set this up to ensure you can get a deduction. In short, the key conditions to consider for interest expense are as follows:

There must be interest expense incurred.

The borrowed funds must be used for purposes of the acquisition of an income-producing asset or for purposes of earning business or investment income.

There should be a direct link between the borrowed funds and its use for purposes of earning income.

The below will provide a general description of interest expense and their deductibility, however, there are some other considerations for what can be considered deductible interest expense. These other considerations are out of the scope of this blog, but we would advise reviewing the CRA’s Folio on Interest Expense for more details. Let’s now explore each of above conditions individually below.

Interest Expense

In general, amounts for interest expense must be:

Calculated on a day-to-day accrual basis;

Calculated on a principal amount (i.e., a loan); and

Must be paid as compensation for use of the principal amount.

What this means is that interest must be on an amount that was borrowed (2), it must be charged to the borrower to compensate the lender (3), and the calculation of this compensation must be done on an accrual basis (1).

An accrual basis typically means that each day the amount will increase, such as if interest is calculated as $1/day, after 5 days you would owe $5. In contrast, an arrangement where you borrow money and on repayment you must pay back a fixed $500 may not be considered an accrual basis, as there are no fixed terms on when it has to be repaid, nor does it increase on a day-to-day basis.

Borrowed Funds

Borrowed funds are typically defined as amounts received as proceeds to which there is a relationship of lender and borrower between two parties. What this effectively means, is that an amount was sent to one party and there is a lender and borrower relationship because of this amount. To support borrowed funds, we would be looking for three key factors:

An amount was sent;

There is a borrower; and

There is a lender.

This could include, but is not limited to, the following situations:

Bank (lender) lends $100,000 (amount) to a business (borrower).

Friend (borrower) receives $5,000 (amount) from another friend (lender) to start their business.

It is important to note, this definition does exclude situations such as an unpaid purchase price for an asset. For example, if someone acquired an asset for $100,000 but has not yet paid this yet, this would generally not constitute borrowed money. These types of relationships are instead treated as seller-buyer relationships, not lender-borrower relationships. This may result in any interest charged on these unpaid amounts as being treated as non-deductible. It is recommended that you discuss these situations with a tax professional to determine deductibility.

Purpose of the Borrowed Funds

The borrowed funds must be used for the purpose of earning income from a business or a property (investment). The general requirement for this purpose is that there is a reasonable expectation of income at the time the investment was made. There are a few terms here that should be considered.

Reasonable

What is reasonable is tricky, as it is very abstract, however, general rule is that if a prudent businessperson would expect that there would be income from their investment it is typically reasonable.

Income

Income for purposes of interest deductibility generally refers to an amount that would come into income for tax purposes. The courts have indicated that they should typically not be concerned with the sufficiency of the income expected or received, or that there needs to be an expectation of income, not guarantees, support, or proof, that this income will arise. This is an important consideration, as this assists with cases where amounts are borrowed but no income is earned, to which in even these cases interest can be deductible, provided there was an expectation to earn income.

One should be careful with this, however, there does need to be a reasonable expectation of this income. As noted above, this would be something that a prudent businessperson would expect. As such, this will not protect you in cases where the chance of income is extremely low or where you attempt to use this as a defence when you really had no intention of earning income at all.

It is also important to note that the courts have indicated that for the purposes of earning income from a business or property (investment) does not include a reasonable expectation of capital gains. As such, for income purposes, we would be anticipating business income, rental income, dividends, interest, or other similar types of income, but typically not capital gains.

Finally, this income does not necessarily need to be made immediately, or even in the next few years, but instead only that there is a reasonable expectation of income. This is the argument that helps support borrowing funds to invest in startups, which the investors are not expecting to earn any income on for several years. Instead, they are hoping that the startup will eventually generate sufficient cash flow to pay dividends in the future.

Purpose

Bringing it all together, for a person to meet the purpose test there needs to be reasonable expectation of income. This expectation does not need to be immediate, as long as it is reasonable to expect that it will come.

It should be noted, that while the courts do not concern themselves with the sufficiency of whether there will be income, it is generally expected that the purpose test will not be met if the income expected does not at least exceed the cost of the borrowed funds. As such, special care should be taken to document this purpose, the expectations, and the actions taken, if possible, to generate this income.

Direct Use

There typically must be a direct use between the borrowed funds and their use, to which the use should be to earn business or investment income. This means that when you borrow the funds, you should ensure that the borrowed funds are directly used to pay for the income producing asset or use.

A common situation we see is where someone wants to convert their principal residence into a rental property. They want to re-finance the home and use the additional funds for a variety of activities. What is often misunderstood is that just because the borrowed funds are secured by an income-producing asset, this does not mean that this automatically gives you a deduction. Instead, the CRA will want to look at what the funds were used for, what was the direct use.

Consider the first of two examples, a person re-finances their principal residence, taking out $100,000 of equity as borrowed funds and uses this to invest in the stock market in a dividend paying stocks in a non-registered account. In this case, the borrowed funds have a clear direct use to investments which we expect to earn income. Given this, typically the direct use test will be met.

Now consider the second example, a person uses $100,000 of their personal funds to renovate their principal residence in hopes of converting it to a rental property. After the renovations are done, they re-finance the home, taking out $100,000 to repay themselves for the renovation costs. In this case, there is not a direct use of the borrowed funds, instead the borrowed funds direct use was to re-pay the person, but not for use in an income-producing asset. In these cases, it is unlikely that the interest will be deductible.

Commingled Funds

There can be situations where borrowed funds are commingled between personal and business or investment uses. Take for example, a home equity line of credit (“HELOC”). A person may borrow $20,000 to pay for personal expenditures in a home and $10,000 to invest in dividend paying stocks in a non-registered account. In these cases, we would take a proportion of the HELOC and apply this between personal and income-producing. Assuming interest expense is $2,000, we could expect the following result.

As we can see, we take the proportion of personal versus investment usage and apply this to the interest expense, resulting in an interest expense for investments of $666.67. It is important to note, that any repayments after this point will be applied to both personal and investment related amounts evenly. Meaning if we made a $15,000 payment, personal would decrease by $10,000 ($15,000 66.67%) and investments would decrease by $5,000 ($15,000 33.33%). Regardless, the same percentage of interest expense is still deductible on the investments.

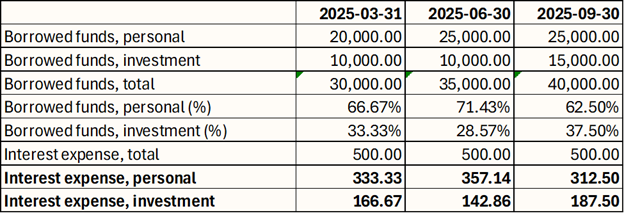

We should also consider what if we borrow more money on this HELOC. Typically, each additional borrowing could change the percentage of funds that are allocated to either personal or investments, resulting in a higher or lower percentage of the interest expense for each. Furthermore, this can get extremely tricky to track, especially in the case of a line of credit that gets used often, which may result in you having to track interest expense each time an amount is withdrawn. Consider the following example as to how this might have to be tracked.

As we can see, each time an amount for the borrowed funds changes, we must change the percentages for personal and investment and recalculate interest. This won’t be automatically tracked by the banks, so you will have to perform this analysis yourself. If you are moving money in and out of a line of credit every week or so this will require a lot of calculations to get right.

Exceptions to the Direct Use Test

There are some exceptions to the direct link test, however, most apply to corporations or partnerships, such as redeeming shares or return of capital, paying dividends, etc. As such, these will be out of the scope of this blog. It is important to understand they can exist, but it is always best to ensure a direct use. See the CRA’s Folio on Interest Expense for more details.

Considerations for the Direct Link Test

When preparing to borrow funds and deduct the interest, it is extremely important you setup your affairs in such as a way that a direct use of the borrowed funds for the income-producing asset or use. This may mean ensuring that funds are deposited into a separate bank account and then used directly for these purchases or use. You want to clearly show that the money was borrowed specifically for income-producing activities.

Interest Expense Recap

To summarize, you will want to ensure that the amounts you are paying are interest, they are from borrowed funds, the purpose of the borrowed funds is for an income-producing asset or use, and that there is a direct use between the borrowed funds and payment for the income-producing asset or use. This requires extremely careful planning, especially when the borrowed funds are significant. As such, it is strongly recommended that you discuss any of this planning with an income tax professional.

Reporting Carrying Charges and Interest Expenses

Carrying charges and interest expense are reported in different sections of the T1 Income Tax and Benefit Return, or personal tax return, depending on whether the interest relates to business or investment income.

Business Deduction

With respect to deducting carrying charges and interest expense in relation to your business, these amounts are deducted on the T2125 Statement of Business or Professional Activities under line 8710 Interest and bank charges. Where the carrying charges are significant and/or do not relate directly to interest or bank charges, it may be more prudent to separate these out and deduct these as Other expense in line 9270.

Where you have multiple businesses with carrying charges and interest expense, you will generally want to separate out these amounts amongst the various businesses and deduct the appropriate amount for each business.

Consider a situation where a person has two businesses, the first is lawn care and the second is window cleaning. The person has incurred a total interest expense of $1,000, of which 40% relates to lawn care and the remaining 60% relates to window cleaning. We would expect the following amounts to be reported on their T2125.

While this separation will generally not result in a difference in the tax result of the person overall, accurate reporting will assist in reviewing their return and could prevent errors where the separation would actually have an impact (i.e., certain restrictions on capital cost allowance may arise where a certain business is in a loss). As such, it is advised that the appropriate calculations take place and the carrying charges and interest expense be appropriately allocated.

Investment Deductions

Carrying charges and interest expenses for investment income are typically simplified and are reported on Schedule 4 Investment Income and Carrying Charges and which will be reported on line 22100 Carrying charges, interest expenses and other expenses on your personal tax return. Accurate reporting involves clearly documenting eligible expenses and maintaining detailed records for potential CRA verification.

Documentation Requirements

Maintaining accurate documentation is essential. Required documents typically include:

Statements or receipts for investment management fees.

Invoices for accounting fees related directly to investment income.

Loan agreements clearly outlining borrowed funds’ investment purpose.

Interest statements detailing amounts paid during the tax year.

Bank statements clearly showing the direction of funds, both in receipt of a loan and for its ultimate use.

Strategic Considerations for Maximizing Deductions

Maximizing your deductions involves several strategic considerations:

Clearly separate investment loans from personal loans to avoid confusion and ensure deductible status.

Strategically borrow funds specifically to invest in income-generating assets.

Regularly consult a tax professional or financial advisor to optimize investment strategies and deductions.

Common Pitfalls and How to Avoid Them

Common mistakes taxpayers make include:

Attempting to deduct interest on loans for non-income-producing investments (e.g., personal home mortgage interest).

Misunderstanding personal versus business or investment expenses.

Mixing deductible and non-deductible interest expenses without clear documentation.

Deducting expenses on registered accounts, such as RRSPs or TFSAs.

Neglecting to keep accurate and thorough records of investment fees and interest expenses.

To avoid these pitfalls:

Ensure clarity about loan purposes at the outset.

Carefully review the purpose of the expense to ensure it is not personal.

Maintain separate records for deductible and non-deductible expenses.

Review where the expense arose from to ensure these were not incurred on registered accounts.

Regularly review investment fees and borrowing structures with a professional.

Special Situations

Special considerations may apply if:

You convert personal debt (e.g., home equity loan) to investment-related debt. Clear tracing of borrowed funds to investments is required.

Investments change from income-producing to non-income-producing. You must adjust deductions accordingly.

In such cases, professional advice can help ensure compliance and optimize deductions.

Summary

Carrying charges and interest expenses provide valuable tax-saving opportunities for Canadians investing in income-producing assets. By clearly understanding eligibility, accurately reporting, and strategically managing these deductions, you can effectively reduce your taxable income and optimize your financial outcomes.

Stay tuned for our next blog post, where we'll cover deductions for tradespersons' tools and their unique tax implications.

KLV Accounting, a Calgary-based accounting firm, is here to help. Contact us today to enhance your financial strategy, minimize your taxes, and drive business success! For a free consultation, call us at 403-679-3772 or email us at info@klvaccounting.ca.

.png)

Comments