Individual Tax Series: Travel Expense Deductions: Maximizing Tax Savings for Work-Related Travel

- Rylan Kaliel

- May 28, 2025

- 12 min read

Updated: Jun 20, 2025

For many Canadians, work-related travel expenses can add up quickly. Fortunately, the Canada Revenue Agency (CRA) allows employees and self-employed individuals to deduct eligible travel costs, helping to lower taxable income. Understanding which expenses qualify, how to document them properly, and the best strategies for maximizing deductions can significantly impact your tax savings. This blog explores travel expense deductions and how to claim them effectively.

Eligible Travel Expenses

The CRA allows deductions for reasonable expenses incurred while traveling for work, including:

Transportation Costs:

Airfare, train, or bus tickets for business travel.

Vehicle expenses (fuel, maintenance, insurance, leasing, depreciation).

Meals and Entertainment:

Deduct 50% of meal and entertainment expenses incurred while traveling for work.

If traveling for multiple days, per diem allowances may apply.

Lodging & Accommodations:

Hotel, motel, or short-term rental costs related to work travel.

Other Expenses:

Parking fees, tolls, taxi fares, and business-related communication costs (e.g., long-distance calls, internet access for work purposes).

Who Can Claim Travel Expense Deductions?

Travel expenses can be deducted if they are directly related to earning employment or business income. You may be eligible if:

You are self-employed and incur travel costs for business purposes.

You are an employee required to travel for work.

You are a commission employee who travels to generate income.

Requirements to Deduct Travel Expenses as an Employee

There are certain restrictions around who can deduct travel expenses as an employee. The CRA outlines these conditions in one of their article, which roughly are as follows:

You were normally required to work away from your employer’s place of business.

You were required to pay your own expenses as they relate to your motor vehicle. This would not be met if you were reimbursed by your employer or if you refuse reimbursement or a reasonable allowance from your employer.

You did not receive a non-taxable allowance from your employer for use of your motor vehicle. Note, some amounts may still deductible if you can prove that the costs were in excess of the allowance, the allowance is included in income, and the other conditions are still met.

You have a completed copy of Form T2200 Declaration of Conditions of Employment from your employer.

For an employee earning a commission (a “commission employee”) an additional condition may be that you were paid in part, or in whole, by commissions or similar amounts. See our discussion under our Employment Expenses blog for more details on what a commission employee and salary employee would be.

Requirements to Deduct Travel Expenses as a Self-Employed Person

As a self-employed person, to deduct travel expenses it is required that the travel expenses were incurred to earn business and/or professional income. This means that the expense was incurred as part of earning this income, such as parking to attend a client meeting, lodging incurred as part of your business and/or professional income earning pursuits, and others. It is important that when these costs are incurred there is support for why the cost was incurred and how it relates to business and/or professional income.

Requirements to Deduct Motor Vehicle Expenses

The conditions to deduct motor vehicle expenses are a bit more complicated. Similar to the above, you need to use the vehicle for business purposes (self-employed) or away from your employer’s place of business (employed), with those kilometres travelled being deductible.

These may include:

Travelling to client sites or meetings

Travelling to work sites that are not your principal/employer’s place of business

Travelling to certain seminars and/or conferences

The most important consideration is what would not be included for these purposes, such as travelling to your principal/employer’s place of business or from your principal/employer’s place of business back home.

For example, if you work from an office downtown and you are travelling from your home to this office, or back home from the office, these trips may not be deductible. It is dependent on what is your principal/employer’s place of business, which can depend on a number of factors. As such, it is recommended that you review your situation with a tax professional to understand which trips are deductible.

With motor vehicle expenses there can also be detailed calculations and supporting information requirements, which we will discuss further below in Travel Log and Documentation Requirements. See also our discussion under our Home Office Expenses blog for more details on what constitutes a principal/employer’s place of business.

Travel Log and Documentation Requirements

As noted above, motor vehicle expenses can require additional documentation to support these deductions. Proper documentation is essential to substantiate travel expense claims. The CRA requires taxpayers to maintain:

Detailed travel logs including:

dates,

destinations,

purpose of the trip, and

total kilometers driven (if applicable).

Receipts for all expenses such as transportation tickets, hotel invoices, and meal receipts.

Form T2200 (for employees) if claiming vehicle or travel expenses as an employee.

With respect to the travel log, this can take a number of forms, such as a notepad that details all of this, to travel log applications. There are a number of travel log applications available on your smartphone that can be used to assist in this tracking, such as:

Everlance

Driversnote

TripLog - Noted that this is largely a free application.

MileIQ – Similarly, a largely free application.

Odotrack – Note that this company can provide a device for your vehicle to assist.

Many of these applications will turn on automatically when you start to drive to help you ensure that you do not miss a trip. Additionally, they will support the classification between personal and business/employment purposes to help with correctly calculating your motor vehicle expenses.

Many of the applications will require that you enter the odometer on the vehicle at the start and the end of the year. You should also take a picture of the odometer at the start and end of the year to support these figures. The odometer at the start and end of the year will be used to support your calculation of amounts for the total kilometres for the year.

The 3-Month Rule for Travel Logs

If using a personal vehicle for business/employment travel, the CRA allows a three-month sample log to estimate annual mileage, provided that travel patterns remain consistent throughout the year. This can simplify record-keeping while ensuring accurate claims.

This three-month sample log requires that there was previously a full year log prepared. The three-month sample is then compared against the full year log from previous years to ensure that they ratio of personal to business remains consistent between the three-month sample to the previous full year log. If this is true, then you do not need to track beyond the three-month sample, which can save you time going forward.

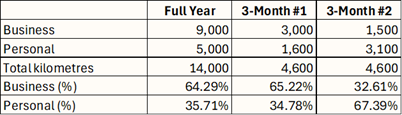

As an example, consider two different three-month samples below when compared to the same full-year log.

For the first log, 3-Month #1, we see that the business percentage is very similar to the Full Year log, therefore, it is likely that you could stop tracking at this point. For the 3-Month #2, the business percentage is significantly different from the Full Year log. In this case, you would need to track for the full year as there are significant differences between the years.

Tracking Started in the Middle of the Year

There can be situations where you start tracking during the middle of the year, say, April. In these cases, you would take a picture of the odometer on the first day of tracking and record this in your log, whether it is a notepad or an application. Similarly, if you stop mid-year, you will record the odometer on the day that you stopped using the vehicle for business or employment purposes.

During the period that you used the vehicle for business or employment purposes you would record each trip, as noted above, and then you would calculate your motor vehicle expenses based on these periods.

Calculating Motor Vehicle Expenses

To calculate your motor vehicle expenses, you would need to review your log, discussed above in Travel Log and Documentation Requirements. You would then need to collect your receipts for any costs related to the vehicle for the full year. This could include:

License and registration fees

Fuel and oil costs

Electricity costs for zero-emission vehicles

Depreciation (capital cost allowance)

Insurance

Interest on money borrowed to buy a motor vehicle

Maintenance and repairs

Leasing costs

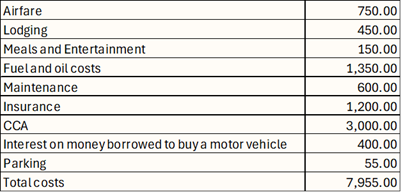

Calculation of Motor Vehicle Expenses

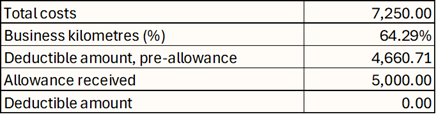

Once you have calculated the total costs, you would multiply the total costs by the business or employment percentage you calculated from your travel log to determine the deductible amount. Consider the following as an example.

In the above, we see that with total costs of $7,250, we are able to deduct just above $4,600 if we used the vehicle for business purposes 64.29% of the time. Depending on your tax bracket, this could provide a sizable tax deduction. See our Basics of Individual Taxation blog for more information.

Motor Vehicle Depreciation (Capital Cost Allowance)

One important note on motor vehicle depreciation (for tax purposes, called capital cost allowance or “CCA”), these amounts are calculated under very specific rules under the Income Tax Act (Canada). These were previously discussed briefly in our Rental Income blog, however, to recap, there are certain rules that guide how much you can deduct.

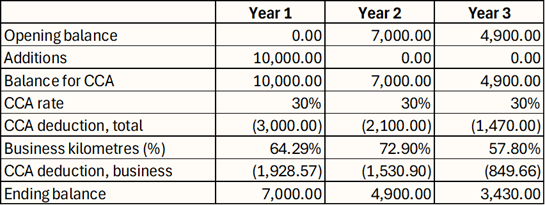

For tax purposes, different assets get assigned a different rate of deduction. Most motor vehicles are included in what we would call Class 10, which gives a 30% rate of deduction. This deduction is done on a declining basis, meaning that the deduction is based on the opening balance, or prior years opening balance, less deduction from previous year. As an example, consider the following to illustrate.

As we can see, the deduction decreases over time, which shows this declining method in action.

The key difference between standard CCA and CCA for a motor vehicle is the percentage that is used for business purposes. This was implied in the above example in Calculation of Motor Vehicle Expenses, but to illustrate this further, consider the following:

As we can see our deduction is reduced for the business percentage year-over-year. Despite this, the ending balance is reduced for the full CCA amount, meaning our deduction will be lower each year despite us not getting this full deduction.

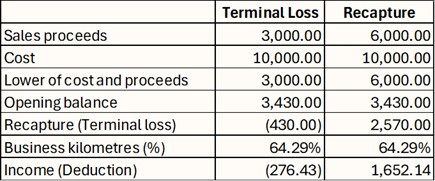

There can be additional tax considerations in the year the vehicle is sold, such as if the vehicle is sold for more or less than the ending balance. Generally speaking, if you have only one vehicle and the vehicle is sold for more than the ending balance you would have recapture (income), if it is sold for less than the ending balance, you would have a terminal loss (deduction). It is important to note, that if you sold the vehicle for more than the cost of the vehicle, then the cost would be used instead (in these cases, you will also have to consider whether a capital gain arises, see our Capital Gains blog for more details).

Both recapture and terminal loss would be taxed based on the business use percentage in the year of disposal. See below for an example.

As can be seen above, under the Terminal Loss column, we have the lower of sales proceeds and cost as $3,000, which is less then our opening balance. Therefore, there is a loss of $430, which at our business use percentage of 64.29% we get a deduction of $276.43. Conversely, where sales proceeds are higher at $6,000, we have income of $2,570 , or a required income inclusion of $1,652.14.

There can be several other rules that cause complications when it comes to claiming CCA on a motor vehicle. As such, it is recommended that these be discussed with a tax professional and tracked appropriately to avoid any issues.

Special Considerations for CCA and Motor Vehicles

The rules above for CCA deductions are simplified for illustrative purposes, however, it is important to note that there can be other rules that could modify the amount of the deduction available. For example, in the past there has been the “half-year” rule, that notes you only get 50% of the deduction in the year of acquisition. More recent there have been the accelerated investment incentive property rules, which gave an additional 50% deduction in the first year of acquisition. In some cases, some properties may also qualify for the immediate expensing incentive, which would give a full deduction of the cost in the year of acquisition. See the below table that would illustrate these rules and their impacts.

Additionally, there can be some limitations to certain motor vehicles, such as motor vehicles with a cost greater than $36,000 or leased vehicles with a monthly cost greater than $950 (most recent published limit at time of writing). These vehicles can have a limit to the amount of CCA or deduction that can be claimed and should be reviewed carefully ahead of claiming a deduction. Further, certain types of vehicles, such as zero-emission vehicles, may provide a better CCA rate then your standard 30% for most motor vehicles.

As a result of these nuances, there should be some care taken when acquiring and taking a deduction, especially in the first year, for motor vehicles. It is advised you discuss these with a tax professional ahead of purchasing a vehicle and claiming a deduction to see if there are any tax opportunities or risk that should be identified.

Direct Expenses

Now that we have worked through those expenses that may have a partial personal usage, let’s discuss those expenses that are directly related to business or employment purposes. Take, for example, lodging while away on a business trip. If the lodging cost you $500 and this trip was entirely for business or employment purposes, we would deduct the full amount. This means that there would be no calculation of the percentage of business purposes, instead, we get a full $500 deduction. This will be illustrated in more detail below in Calculating Travel Expenses.

Allowances and Reimbursements

As was discussed above, there can be some adjustments where an allowance or reimbursement is received. First, let’s differentiate between the two:

Allowance: This is a fixed amount you receive for each kilometre driven, meal incurred, etc. Often these are quoted, for example, $0.27/kilometre drive.

Reimbursement: This is a direct repayment of any costs incurred, such as if you incurred $150 for fuel and gas, $33 for meals, and $500 for lodging and were paid based on the receipts you provided your employer, then this would be a reimbursement.

As noted in Requirements to Deduct Travel Expenses as an Employee above, if you receive a reimbursement, then you cannot deduct the travel expenses that were reimbursed. If you receive an allowance, however, you can only deduct the amounts that were incurred in excess of the allowance. As an example for allowances, consider the following:

In the above example, we technically incurred $4,600.71 of costs, however, we received an allowance of $3,000. As such, the actual deductible amount is the difference between the two of $1,660.71. As noted above in Requirements to Deduct Travel Expenses as an Employee, for the amount to be deductible the allowance must be included into income. This would mean that we would have a $3,000 income inclusion and then a deduction of $4,660.71.

One important factor to consider is what if the allowance is in excess of the deductible amount, such as in the following example.

In this case, our allowance is greater than the deductible amount. Provided that the allowance is reasonable, that is it is what we would expect a normal business to pay their employees as an allowance, then there would not be a deductible amount, but the allowance would not be taxable to you. This means that while technically you got paid more than the expense, you do not need to pay tax on the excess allowance.

Note, both examples illustrate a situation where only a portion of the cost is deductible, however, the same logic would apply to those direct costs incurred.

Calculating Travel Expenses

Now that we have walked through the major expense categories, let’s walk through an illustrative example.

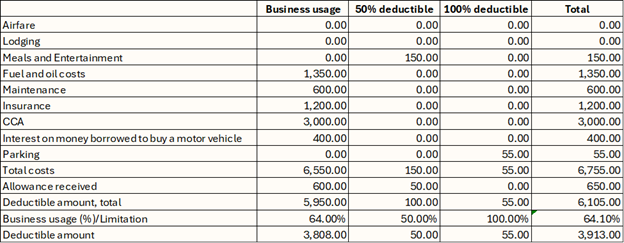

Let’s assume the following facts:

The individual is an employed person who meets all the conditions to deduct the amounts.

Airfare was reimbursed in full, whereas lodging was reimbursed only 50%, as the individual decided to get a fancier hotel for their stay.

A meals and entertainment allowance of $50 was received.

A driving allowance of $600 was received.

The vehicle was driven for 64% business use.

All allowances and reimbursements were considered to be reasonable.

Based on the above situation, we would expect the following analysis to be prepared.

As we can see in the above table, we separate these out into various buckets so we can apply the correct percentage. For those dependent on the business usage, such as the motor vehicle expenses, we include these in the first column. For meals and entertainment, a separate bucket is used, as only 50% can be deducted, so it goes in the second column. Finally, the third column is for the remaining expenses, which are fully deductible. You can add or remove columns as needed if there are different business usages for the expenses.

Another key item to note are that the airfare and lodging are not included, as they were reimbursed. Despite the fact that the lodging was not fully reimbursed, it was still a reimbursed cost, which means that no deduction is available. For the allowances, we have reduced our deductible costs, although for reporting purposes we would include the allowances into income and claim the full deduction.

Reporting

Reporting these on your return can vary depending on whether you are employed versus being self-employed. The reporting is done on the following forms.

Employed: T777 Statement of Employment Expenses

Self-Employed: T2125 Statement of Business or Professional Activities

Common Mistakes to Avoid

Claiming personal travel as a business expense – Ensure only work-related travel is deducted.

Forgetting to retain receipts and logs – CRA audits often request documentation to support claims.

Failing to obtain a T2200 form (if required) – Employees must have employer certification to claim certain deductions.

Strategies to Maximize Travel Expense Deductions

Use digital apps (e.g., mileage tracking apps) to maintain accurate records.

Keep travel-related expenses separate from personal expenses to simplify reporting.

Combine work-related trips with conferences or client meetings to increase deductible costs.

Summary

Claiming travel expense deductions can help reduce taxable income for self-employed individuals and eligible employees. Maintaining proper documentation, understanding CRA requirements, and strategically managing travel-related costs ensure compliance while maximizing tax savings.

Stay tuned for our next blog, where we’ll explore union dues and professional memberships and how they can be deducted.

KLV Accounting, a Calgary-based accounting firm, is here to help. Contact us today to enhance your financial strategy, minimize your taxes, and drive business success! For a free consultation, call us at 403-679-3772 or email us at info@klvaccounting.ca.

.png)

Comments