Individual Tax Series: Charitable Donations Tax Credit: Maximizing Your Tax Savings Through Generosity

- Rylan Kaliel

- Aug 19, 2025

- 17 min read

Updated: Aug 25, 2025

Supporting charitable causes is not only beneficial for communities but also provides valuable tax incentives for donors. The Canadian government encourages charitable giving through the Charitable Donations Tax Credit, which helps reduce your tax burden while supporting meaningful causes. This blog explains eligibility criteria, how to claim the credit, and strategies for maximizing your charitable donation tax benefits.

What is the Charitable Donations Tax Credit?

The donations tax credit is a non-refundable tax credit designed to encourage Canadians to contribute financially to registered charities. Donations to eligible charitable organizations qualify for this credit, significantly reducing the taxes you owe.

Eligible Donations

Eligible donations include monetary gifts and gifts of property to:

Registered Canadian charities.

Registered Canadian amateur athletic associations.

Municipalities, provinces, or territories (not including political parties, see our upcoming blog post on Political Contributions Tax Credit for more details).

Certain registered national arts or educational institutions.

There are several other entities that you may make an eligible donation to that are not included on the list above, if you donated and do not see this on the list above, consider consulting with a tax professional to confirm if this is still an eligible donation or review the CRA’s website for a listing of these entities. As a note, donations must be voluntary and made without receiving direct benefit in return, with some exceptions.

Value of Your Donation

The value of your donation may differ depending on whether you are donating cash or property. This value is important, as it determines how much is used in the calculation of the donation tax credit (as is discussed in Donation Calculation below). As such, ensuring that you get the most value out of your donation, while managing other tax consequences that may arise on making the donation, becomes important. See below for a discussion of donating cash and donating property below.

Donating Cash

The most common type of donation is cash, or even near cash, such as gift cards. For donations of cash or near cash, there is typically no additional rules, your donation is simply the value of the cash or near cash. These differ from Donating Property, which is discussed below. As such, when you make a cash or near cash donation, the value is simply equal to the value of the cash or near cash given up.

Donating Property

Donating property can become trickier, as sometimes the value of the property is not easy to determine. Further, there can be specific rules that may apply that alter the value of the donation and impact the amounts used in the calculation of certain tax effects. Some high-level comments on donating property are noted below.

Most capital property donated will result in a capital gain or loss being realized based on the capital gain or loss that has accrued to the date of the donation (see our Capital Gain blog post for more details). You will need to determine the fair market value of the donated property at the time of the donation to calculate this capital gain or loss.

Some capital property donated may still result in a capital gain or loss being realized, however, certain properties can have different tax implications, such as jewelry or your golf club collection. This may result in restrictions on capital losses or other uncertain tax consequences. As such, it is advised that you discuss the donations of property with a tax professional prior to making the donation so that you can fully understand the tax consequences.

Where the property is not capital property, such as a donation of inventory, you will realize income or loss on the donation of this property based on the fair market value of the donated property at the time of the donation.

There may be differences in the tax implications depending on who you donate the property to. As such, it is advised you discuss the donation with a tax professional ahead of making the donation.

With respect to capital property, there may be options to reduce the amount of the capital gain realized on this disposition. Specifically, you are allowed to select that the proceeds of disposition be less than the fair market value, however, this amount may not be lower than the greater of the following:

The amount of the advantage realized on the gift; and

The adjusted cost base, or in the case of depreciable property, the lower of the adjusted cost base or the undepreciated capital cost or the classThe term advantage essentially refers to any compensation, property, value, or really any amount received by virtue of making the gift. Consider the following situation, you donate land with a fair market value of $100,000 to a local charity. In exchange, the charity provides you with free marketing for a year with an estimated value of $25,000. The advantage here would be the $25,000 in marketing.

Let’s look at this example further, let’s say the land has an adjusted cost base of $20,000, what would be the lowest amount you could elect to be the proceeds of disposition?

In the above scenario, we must compare the value of our advantage to our land’s adjusted cost base, taking the greater of these amounts for the minimum amount we can elect for our proceeds of disposition. In this case, the advantage is the larger amount, so we can not select an amount less than our advantage of $25,000. This means, that you could select to have our proceeds of disposition be anywhere between $25,000 and $100,000.

While this type of calculation may reduce the amount of the capital gain realized on the donation, it will also reduce the value of the donation for purposes of the donation tax credit. Where you elect to have a different value for proceeds of disposition, you will also be required to use these proceeds of disposition as your value for the donation tax credit. Therefore, it is advised that you have a tax professional review the donation and potential tax consequences to ensure that the elected amount provides the greatest benefit for your taxes.

Where an election is not made, the value of the gift and the proceeds of disposition would be considered to have arisen at fair market value. This may result in a larger capital gain, but also a greater value used for your donation tax credit.

Please note, determining the value of property can be difficult, especially when it comes time to report the amounts on your tax return. As such, where you are donating property, especially when the property has a significant value, you should contact a professional appraiser to determine the value of the property and a tax professional to appropriately include these on your return.

Donation Calculation

Donation Limit

The amount you can claim for your donation tax credit is limited to 75% of your net income for tax purposes for the year (see our Basics of Individual Taxation blog for more details on what is included in net income for tax purposes). This means that if you earned $100,000, you may not be able to donate the entire amount and claim a donation tax credit for the entire amount. Let’s assume you had net income for tax purposes of $100,000, the table below illustrates the maximum amount of donations you can claim in the year.

As can be seen, the amount you can include as a donation tax credit is $75,000, or 75% of $100,000. This means that the maximum donations you can make in the year under the donation tax credit is $75,000. If you made more donations in the year, please see Carrying Forward Charitable Donations below for more details.

A further nuance to this calculation is that if you incurred any capital gains during the year this will increase the donation limit by 25% of the taxable capital gains (see our Capital Gain blog post for more details on what a taxable capital gain is). Let’s modify our example by saying we have net income for tax purposes of $100,000 which includes $10,000 of taxable capital gains and calculate our limit for donations.

As we can see, we start the same as above, with a limit to donations, pre-taxable capital gains of $75,000. However, we then must increase our limit by 25% of the taxable capital gains, or $2,500. The sum of these two is $77,500, which would be our limit for donations for the year.

Note, you may also get an increase to the donation limit for any recapture arising on the donation of capital property that is depreciable property (see our Travel Expense blog for details on recapture). This recapture increase is limited to the lower of the proceeds of disposition and the recapture arising on the gift. Further, this is also reduced by 25% of the amount determined.

Let’s do a final example, assuming net income for tax purposes remains at $100,000 which includes taxable capital gains of $10,000 and $5,000 of recapture. Let’s look at how the donation limit is calculated with these three amounts.

In the above table we split the calculation into three separate buckets for net income for tax purposes, taxable capital gain, and recapture, as each can have differing calculations. We noted that we take their respective income amount and multiply it by their specific limiting factor. We then add all the amounts together to determine a donation limit of $78,750.

Calculating the Federal Donation Tax Credit

The calculation of the donation tax credit can be complex and may be dependent on your taxable income for the year. Starting with the federal tax credit, the calculation of the donation tax credit is as the total of the following:

A 15% *the lessor of the donations made and $200

B 33% * the lessor of the taxable income in excess of the highest marginal tax bracket ($253,414 for 2025) for the year and the donations made less $200

C 29% * the donations made, less the donations already claimed under A and B aboveWhat this calculation does is essentially limits the donation credit you get to a lower rate for the first $200 and then gives you a higher rate for donations in excess of $200. The reasoning for B is that if you are taxed at a rate of 33%, you should get a credit at this highest rate of tax, but only up to the income that is taxed at this rate. If you are not at the highest rate of tax, or you donated more than the income that exceeds the start of the highest rate of tax bracket, then you would get the next highest tax rate on your donations. Please review our Basics of Individual Taxation blog for details on tax brackets and tax rates.

Let’s look at a few illustrative examples of this. Let’s start with a situation where an individual earns $270,000 of taxable income and donates $100,000. Let’s calculate both their taxes payable, before credits, and the donation tax credit. Let’s start with the taxes payable.

In the above, we calculate our taxes payable, before credits, based on the marginal tax rates applicable to the taxable income, see our Basics of Individual Taxation blog for more details on how this is calculated. We arrive at a total tax payable of $64,402. Now let’s calculate the donation tax credit.

The above works through the donations rates one-by-one, starting with the first $200, which is applied at a tax credit rate of 15% for a credit of $30. The next notes that we had taxable income in excess of the highest marginal tax bracket, thus the person was taxed at 33% and calculates the lower of the total donations less $200 of $99,800 ($100,000 - $200) or taxable income less the top tax bracket of $253,414 for $16,586 ($270,000 - $253,414), which at a tax credit rate of 33% is a credit of $5,473.38. Finally, we take whatever donations that have not yet been included of $83,214 ($100,000 - $16,586 - $200) at a tax credit rate of 29% is a credit of $24,132.06. We add all of these up to determine our total federal donation tax credit of $29,635.44.

An interesting thing to note here is that technically the donation tax credit provided a better deduction then what we were taxed at. If we take our taxes payable, before credits, of $64,402 and divided this by our taxable income of $270,000, we are effectively taxed at a marginal rate of 23.85%. Comparatively, if we take our federal donation tax credit of $29,635.44 and divide this by our donations of $100,000, we get a tax credit rate of 29.64%. This means that each dollar of donation saved us more tax than what we were taxed on. This demonstrates that the use of a flat 33% and 29%, which is higher than most of the marginal tax rates, benefits us from a tax perspective.

Let’s look at another example, let’s assume a person has taxable income of $100,000, which results in taxes payable of $17,344, or roughly 17.34%. This person also made donations of $1,000. Let’s calculate the federal donation tax credit.

In the above example, we note that the person does not have taxable income that is taxed at 33%, so the second calculation doesn’t apply. Instead, we simply calculate the first $200 at 15% and then the remaining $800 at 29%, for a total federal donation tax credit of $262. Interestingly, our effective tax rate on income is around 17.34%, but our donations tax credit rate is 26.20%, meaning we got a much larger tax benefit from making the donation. This effectively resulted in us not only covering our tax of 17.34%, but also further reducing our tax by 8.86%. Better said, we got a benefit beyond saving tax of 8.86% for each dollar of donation.

Let’s now look at one final example, let’s assume a person has taxable income of $100,000, which results in taxes payable of $17,344, or roughly 17.34%. This person also made donations of $150. Let’s calculate the federal donation tax credit.

In the above example, as the donation did not exceed the first $200, we limit our donation tax credit to the amount of the donation, or $150, which at a rate of 15% is $22.50. The other lines do not apply as there are no donations in excess of $200 and thus the amounts remain at $0. Therefore, our total is only $22.50. In this case, our effective tax rate is 17.34%, but our donation tax credit rate is now only 15%. This means that our $150 donation is not enough to offset our effective tax rate on our income.

The above intends to illustrate how this credit is calculated, but also to illustrate that this donation tax credit can be a very effective tax planning tool. It can effectively reward you with additional tax benefits for donating to good causes. Given this, it may be important to consider what value you can get out of the donation come tax time and if you want to make a donation, it may be important to make it before the end of the year, especially if you are close to passing the first $200 threshold.

Calculating the Provincial Donation Tax Credit

The rules around provincial tax credits vary based on province and as such, a full discussion of each provinces donation tax credit is out of the scope of this blog. We would recommend you review TaxTips.ca’s article on the provincial donation tax credits for more details.

Generally speaking, the tax credit rate and rules will vary by province with some provinces differing from the federal approach. As an example, in Alberta there is a 60% tax credit rate on the first $200 and then a 21% rate of donations on anything in excess of the first $200. This would emphasize that the first $200 is more valuable than any donations in excess of this first $200, which is contrary to the federal approach.

Donation Splitting

Where you have a spouse or common-law partner, you can allocate donations amongst the two persons. This means that if one person donated $100 and the other donated $500, one person could claim the full $600. Where the combined donations exceed $200, it is often preferrable to have one person claim the full donation tax credit, as it will avoid the lower rate of 15% from applying twice.

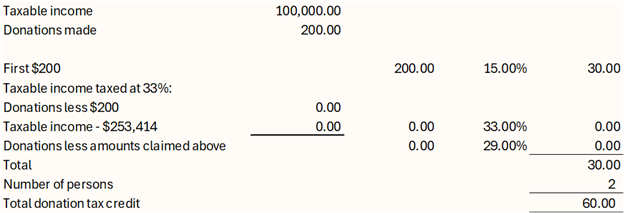

Let’s look at an example of this. Let’s say a married couple each have a net income for tax purposes of $100,000. Each person donated $200 in the year. Let’s first look at what the federal donation tax credit would be if they each claimed their own donation.

In the above example, we see that we get a federal donation tax credit of $30 for each person, which multiplied by 2 results in a federal donation tax credit of $60 for the married couple. Now let’s assume that one person allocates the donation to the other, giving this one person a donation of $400.

As we can see, the federal donation tax credit for the married couple has now increased to $88, a $28 increase for the same total donation. This illustrates that if we can get past the first $200, it can be beneficial to have just one person claim the donation tax credit.

Let’s now consider a situation where we have two persons that are considered common-law partners. The first common-law partner has a net income for tax purposes of $100,000, the second has a net income for tax purposes of $300,000. Both partners each make a donation of $200.

If each partner were to only claim their own donation, we would anticipate a federal donation tax credit together to be $60, same as the example noted above. But now let’s look at if they opted to have the higher income partner claim the donation tax credit.

In the above situation, we note a further increase to $96, a $8 increase over previous married couple example. This illustrates that if one partner has an income over the highest marginal tax bracket it is ideal to have them claim the donation tax credit and receive the refund.

It is important to note that most tax software will optimize the donation tax credits to obtain these benefits, meaning this calculation is automatic. This can greatly reduce the time it takes to ensure you get the best benefit and increase your refund without any additional work. That said, if you prefer having the donation claimed by the person who made the donation, you should check your tax software to ensure that these optimizations are turned off.

Carrying Forward Charitable Donations

As was discussed in Donation Limit, your donations are limited to a specific amount of your net income for tax purposes, taxable capital gains, and recapture. Generally, if your total donations exceed 75% of your net income for the year, you can carry forward excess donations for up to five years. This means that even if the donations are not eligible to be included in the donation tax credit for the year, they may be deductible in future years.

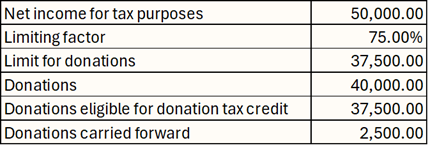

Let’s look at this in an example, let’s say an individual had net income for tax purposes of $50,000 and made donations of $40,000. Let’s determine what would be eligible for the donation tax credit and what would be carried forward.

In the table above, we note our limit is $37,500, whereas our donations are greater than this for $40,000. As such, we are limited to only included $37,500 for the donation tax credit. The remaining $2,500 would be included as a donation carry forward, which can be carried forward 5 years.

In subsequent years, we would then review our donation limit and the donations carried forward to determine our amounts we can include in the donation tax credit. Let’s assume that net income for tax purposes remained as $50,000, we carried forward the $2,500 of donations but also made an additional $10,000 of donations.

In the above table, we note that our total donations available is our donations made of $10,000 plus our donations carry forward of $2,500, for a total of $12,500. As this amount is less then our limit for donations we can include the entire amount in our donation tax credit.

Please note, even where there is a donation carry forward you can still split the carry forward with your spouse or common-law in future years, as was discussed in Donation Splitting.

If donations are not used after 5 years they will expire and no longer be available. As an example, if we had a donation carry forward of $10,000 in 2019 that was not used by 2025, this amount would expire and no longer be available for this. This emphasizes that it can be important to ensure that you have sufficient net income for tax purposes to utilize any donation carry forwards.

Further, if you intend on making a larger donation in one year, it may be worthwhile to determine what the expected net income for tax purposes will be for you over the next five years to ensure you can utilize the full donation as a donation tax credit. In some cases, it may be worthwhile to stagger the donation across multiple years to effectively use these amounts. It is advised that you discuss these approaches with a tax professional to ensure you best utilize your donations for tax purposes.

Donation Receipts

In order for you to claim the Charitable Donations Tax Credit you are required to receive and retain a copy of the donation receipt. This receipt should include:

Your name

The date of the donation

The amount of the donation

Name of the charity or organization that is issuing the receipt

The charity or organization’s registration number

The type of charity or organization that is issuing the receipt (i.e., registered charity, government body, etc.)

Please note, the above is a general listing of what is required to be included on a donation receipt. For more information on what must be included please see the CRA’s website.

If you file electronically, you generally will not be required to submit these receipts as part of your tax return. Retain a copy of these receipts in case the CRA asks for them.

As was discussed in Eligible Donations, only registered Canadian charities or other qualified donees can issue official donation receipts that qualify for the donation tax credit, however, they are not necessarily obligated to issue these receipts. It is important to ensure that your donation is being made to a registered Canadian charity or other qualified donees to ensure you can claim the donation tax credit. The CRA provides a listing of these entities on their website.

Please note, there are also some situations in which you may claim a donation to a U.S. charity, which include:

You must have U.S. sourced income

The U.S. charity is exempt from U.S. tax

The U.S. charity could qualify in Canada as a registered charity if it were resident in Canada and it was created or established in Canada

The amount you can claim is limited to 75% of your U.S. sourced income, similar to the rules noted in Donation Limit. Additional rules may apply to modify this limit depending on your circumstances.

How to Claim Charitable Donations

Claiming charitable donations involves:

Reporting total donations on Schedule 9 of your personal tax return.

Including your net income for tax purposes, taxable capital gains, and recapture on Schedule 9 of your personal tax return.

Retaining official donation receipts from registered charities as documentation.

Entering the total eligible amount on Line 34900 of your tax return.

Please note that it is extremely important to report all donations made in the year to have these amounts deducted. Further, it will be important to include donations even if you are not able to deduct them in the year to ensure these are included as a carry forward.

Documentation Requirements

Keep detailed records, including:

Official donation receipts indicating the charity’s registration number, donation date, and amount.

Appraisal documents for property donations indicating fair market value.

While on electronic filing you may not have to provide the CRA with these receipts at the time of filing, however, it is important to retain these in the case the CRA asks for them.

Strategic Considerations to Maximize Your Benefits

Consider these strategies to enhance your charitable donation tax savings:

Combine donations from multiple years to surpass the $200 threshold, benefiting from higher credit rates.

Strategically donate appreciated securities or mutual funds directly to charities, eliminating capital gains taxes.

Coordinate donation strategies with your spouse or partner to optimize total household tax credits.

Common Mistakes and How to Avoid Them

Common errors include:

Not obtaining official donation receipts.

Claiming ineligible donations (e.g., donations without proper documentation or to entities that do not qualify).

Failing to strategically time donations.

To avoid these pitfalls:

Verify charity registration and obtain valid receipts.

Keep thorough records for all donations.

Plan donation timing carefully to maximize your credit.

Impact on Other Benefits

Claiming charitable donations can reduce your taxes payable, potentially improving eligibility for income-tested benefits such as GST/HST credits or Canada Child Benefit.

Summary

The Charitable Donations Tax Credit provides a meaningful way to support causes you care about while achieving significant tax savings. Understanding eligibility, documenting donations accurately, and applying strategic planning ensures you optimize this beneficial tax credit.

Stay tuned for our next blog, where we'll discuss the political contributions tax credit and how to leverage it effectively.

KLV Accounting, a Calgary-based accounting firm, is here to help. Contact us today to enhance your financial strategy, minimize your taxes, and drive business success! For a free consultation, call us at 403-679-3772 or email us at info@klvaccounting.ca.

.png)

Comments