Individual Tax Series: Tuition Tax Credit and the Canada Training Credit: Maximizing Your Tax Savings for Education Expenses

- Rylan Kaliel

- Jul 9, 2025

- 14 min read

Pursuing post-secondary education can be costly, but Canada offers financial relief through the Tuition Tax Credit and the Canada Training Credit. These valuable credits helps students and their families reduce the tax burden associated with tuition fees. This blog post explores the eligibility criteria, how to claim the tuition tax credit and Canada Training Credit, and strategic considerations for maximizing your tax savings.

What is the Tuition Tax Credit?

The Tuition Tax Credit is a non-refundable tax credit designed to provide financial relief by reducing taxes owed based on eligible tuition fees paid to post-secondary institutions. This credit helps students and their families offset the costs associated with higher education.

Eligibility Criteria

Eligibility differs on whether or not the educational institution is in Canada. To qualify for the tuition tax credit for educational institutions in Canada, tuition fees must either be paid for a course:

At a post-secondary institution; or

For individuals 16 years or older at the end of the year who are developing or improving skills in an occupation and the educational institution has been certified by the Minister of Employment and Social Development Canada.

To qualify for the tuition tax credit for educational institutions outside of Canada, or for courses at educational institutions in Canada that are not at the post-secondary level, the tuition fees must be paid for a course where the following are met:

The individual is 16 years of age or older before the year; and

The individual is enrolled in the educational institution to obtain skills for, or to improve their skills in, an occupation.

For educational institutions outside of Canada, either of the following must be met:

The individual must be a student in full-time attendance at a university outside of Canada in a course that leads to a degree at not lower than a bachelor’s degree or equivalent level (i.e., courses must lead to a bachelor's degree or equivalent); and

The fees for the courses are for a course that is not less than three consecutive weeks for each course.

The individual is enrolled at a university, college, or other educational institution in the United States providing courses at the post-secondary level, and the following are met:

The student resided throughout the year in Canada near the boundary between Canada and the United States; and

The student commuted to that educational institution in the United States.

The CRA maintains a list of the recognized universities and higher educational institutions outside of Canada that can be referred to in order to ensure that the amounts should qualify for the tuition tax credit, which can be found here. Please note, this listing does not guarantee that you will receive a tuition tax credit, but that tuition fees paid to this educational institution may qualify for this credit.

For the above, the fees you paid to attend each educational institution must be more than $100.

You cannot claim the tuition amount if any of the following apply:

The fees paid were reimbursed by your employer, or an employer of one of your parents, where the amount is not included in your or your parent’s income.

The fees were paid by a federal, provincial, or territorial job training program, where the amount is not included in your income.

The fees were paid (or eligible to be paid) under a federal program to help athletes, where the payment or reimbursement has not been included in your income.

There are a few terms that are helpful to understand as part of this, which include:

Educational institution: This is generally accepted to be a university, college, or other educational institution.

Other educational institution: This can include professional organizations, provided that they provide educational courses at a post-secondary level and at least one of the minimum qualifications is that the individual graduated from secondary school. This would not include a professional organization that provides evaluation, examination, or other such services, but does not provide educational courses.

Post-secondary institution: This is generally accepted to be an educational institution where the courses taken are post-secondary.

Educational institution has been certified by the Minister of Employment and Social Development Canada: This is typically a listing provided by the Minister of Employment and Social Development Canada that indicates what non-post-secondary institutions would still be eligible for the tuition tax credit.

Occupation: This typically refers to a job or career, to which developing or improving skills may mean taking courses that would advance you in this job or career, such as a course of welding for mechanics. It is important to note that to claim the tuition tax credit, sufficient skills must have been acquired through this training, meaning that an introductory course that does not enable you to work a job or career would typically not qualify, unless the remaining courses to work this job or career are also taken (i.e., you would not have developed skills to work in this job or career).

Full-time attendance: This is typically met if the educational institution regards you as being in full-time attendance. This may vary between universities, so obtaining a certificate from the educational institution that states you were in full-time attendance is recommended. Please note that the following are not considered to be in full-time attendance with the CRA:

Only a few subjects or evening classes are being taken;

Courses are taken only by correspondence (not including online courses provided the courses are scheduled, interactive, course-related activities conducted over the internet); or

Although a day student, the student is only carrying a minor course load and is at the same time is devoting so much of their time to other activities (i.e., working, etc.) that the other activities are clearly the student’s primary occupation.

Bachelor’s degree or equivalent: This is met if the educational institution is recognized by an accredited body (that is nationally accepted in that country) as being an educational institution that confers degrees at least at the bachelor degree or equivalent level.

What Expenses Qualify?

Qualifying tuition fees generally include:

Tuition fees paid directly to educational institutions, including:

Fees paid for courses

Application fees (only if the student subsequently enrolls in the institution)

Confirmation fees

Admission fees

Academic fees

Charges for use of library or laboratory facilities

Mandatory computer access fees

Membership or seminar fees that are specifically related to an academic program and its administration

Charges for certificate, diploma, or degree

Examination fees required for obtaining professional status or licensing.

Mandatory ancillary fees (lab fees, mandatory student association fees), not to exceed $250 unless they are required to be paid by all individuals taking an examination.

Expenses not eligible include textbooks, accommodation, student association fees, transportation costs, and living expenses.

Tax Impact of Claiming the Tuition Tax Credit

The tuition tax credit is a non-refundable tax credit, as was discussed in our Basic Personal Amount blog post. This means that if the reduction to taxes payable exceeds the actual taxes payable amount, then the additional reduction is lost (i.e., reduction to taxes payable cannot result in a refund). This was discussed and illustrated in our Student Loan Interest blog post.

The tuition tax credits are included with other non-refundable tax credits and grouped up before applying the lowest tax rate to these to determine the reduction to taxes payable. For the purposes of illustrating this, let’s assume that you incur $10,000 of eligible tuition fees and are entitled to only the basic personal amount otherwise. The reduction to taxes payable for these tax credits would be calculated as follows.

As we can see above, the inclusion of the tuition tax credit increases our reduction to taxes payable. This increase is roughly 15% of $10,000, or $1,500, a pretty reasonable reduction. Please note, the above is for federal purposes only and would be increased for the provincial impact.

Carry Forward and Transfers of Tuition Tax Credits

Similar to student loan interest, the amount can be carried forward if it isn’t deducted in the year. Additionally, the tuition tax credit can be transferred to a spouse, common-law partner, parent, or grandparent up to a maximum of $5,000. This transfer is limited by the amount of income taxes payable of the student, in that if the student still has taxes payable before using the tuition tax credit a transfer cannot take place.

The formula to determine this transfer is as follows:

A - B

A the lessor of:

The amounts the student may claim for the year as a tuition tax credit; and

$5,000 * the lowest tax rate percentage for the year (2024 – 15%, expected to decrease to 14% for 2025 and onward, federal only)

B is the

Students income taxes payable after deducting the standard personal tax credits, including the basic personal amount, unused tuition tax credits (discussed further below), and others.Let’s assume that a student has $10,000 of tuition tax credits incurred in 2025 and no unused tuition tax credits. The student has taxes payable, before other tax credits, federally, of $2,600. First, we have to determine how much the taxes payable are, before the tuition tax credits.

As we can see in the above, we have a small amount of net taxes payable. This will then be used to reduce the maximum amount that can be transferred, as will be seen below.

As we can see above, the maximum amount available to transfer is reduced from a maximum of $750 to $569.35, by virtue of the student’s net taxes payable being more than $0. As such, it is advisable that the student utilize a portion of their tuition tax credits personally to reduce their own net taxes payable to $0. Please note that using the tuition tax credits incurred in the current year will not increase the amount that can be transferred, however, if you utilize the tuition tax credits carry forward from previous years (as will be discussed below) this can increase the amount that is transferred.

Where the tuition tax credits cannot be used or transferred, a carry forward exists for these. These are very similar to as was discussed in our Student Loan Interest blog post.

To illustrate this, let’s follow from the above example, you incur $10,000 of eligible tuition fees, to which you transferred a portion and utilized a separate portion, as was noted above. As these amounts are after applying the tax rate, let’s bring these back to the before tax amount and then determine the remaining tuition tax credits available for carry forward.

As can be seen, we can take the total tuition tax credits incurred in the year and reduce them for the transferred and utilized tuition tax credits to determine the remaining tuition tax credits available for carry forward. This can be done as both after-tax, which is useful for determining the tax benefit that can be achieved, or before tax, which is better for visualizing the actual costs incurred and carried forward. Please note, the after-tax amounts are only for the federal tax rate and would generally be higher if you included your provincial tax rate.

When we review our carry forward amounts, we would track them similar to how we did in our Student Loan Interest blog post. Let’s assume that the above example was the previous year and this year we incur $7,500 of eligible tuition fees and utilize $2,000 of the tuition fee tax credits, no amounts are transferred.

As we can see, we retain the opening balance noted above of $5,000, add our eligible tuition fees incurred in the year of $7,500, and then reduce for amounts transferred and/or applied of $2,000, to get a carry forward of $10,500. This means that in future years we can deduct these against our income, which using the federal tax rate of 15% would give us a total reduction of $1,575 for future years.

You’ll note that for the carry forward we use the before tax amounts. This is because it is easier to track and is not subject to any changes in the lowest tax rate. As of July 1, 2025, the lowest federal tax rate is expected to decrease from 15% to 14%, which means that this deduction could decrease to $1,470, or a decrease of $105. As such, tracking the before tax amount is not subject to these changes in tax rates and is thus more reliable to review.

What is the Canada Training Credit?

The Canada Training Credit (CTC) is a refundable tax credit that can be received provided certain conditions are met.

There is a limit on the amount of the CTC that can be claimed, which this limit, the Canada Training Credit Limit (CTCL), is increased by $250 each year, up to a lifetime maximum of $5,000, provided the following conditions are met.

You file an income tax and benefit return for the year

You were a resident of Canada throughout the year

You were at least 26 years of age and less than 66 years of age at the end of the year

In order to make a claim under the CTC, the following must be met.

Your Canada Training Credit Limit (CTCL) for the year is more than zero

Tuition or other fees were paid to educational institutions during the year

The tuition and/or other fees were eligible for the tuition tax credit

Where you are making a claim under the CTC, the amount of CTC you can get is based on the lower of the following two amounts:

Your CTCL for the year; or

50% of the eligible tuition and other fees paid to an eligible educational institution for the year

The value of this benefit is that 50% of your tuition costs can be treated as refundable, meaning that instead of the simple 15% (for federal purposes) you get the 50%, a big increase. Additionally, this amount is refundable, meaning that even if you don’t have taxes payable you can still receive this amount.

Tax Impact of Claiming the Canada Training Credit

The CTC will operate very similarly to the tuition tax credit, however, it will calculate what your CTCL is and then determine how much of the claimed tuition tax credit can be converted into CTC.

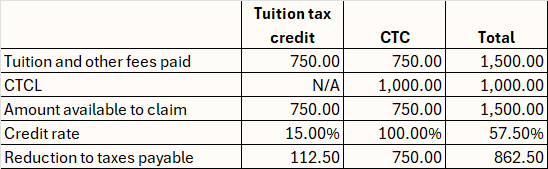

Let’s assume that a student has $1,500 of tuition tax credits incurred in 2025 and no unused tuition tax credits. This student has a CTCL of $1,000. Let’s determine how much their CTC and tuition tax credits will be.

As we can see above, 50% of the tuition and other fees paid in the year are claimed as a CTC, the remaining amount is claimed as a tuition tax credit. We then compare the CTC to our CTCL, which in this case the CTC is less than the CTCL, so we claim the entire CTC. The CTC is essentially a 100% credit, although it is previously limited to 50% of the tuition and other fees paid, so we get a full refundable credit of $750. The tuition tax credit is included at a rate of 15% (federal only), so we get a non-refundable tax credit of $112.50. This results in a total reduction of $862.50 to our taxes payable.

You’ll note that the actual credit we get for our taxes is 57.50% of the amounts paid. This means that more than 50% of your tuition costs are recovered through tax savings, greatly decreasing the cost of your education. Additionally, this is before including the impacts of your provincial tuition tax credit, which could increase this even more, potentially getting closer to a 70% tax savings, or your education only costing you 30% of what you actually pay!

As such, it is extremely important to monitor your CTCL and ensure you use these credits effectively. In our above example, we didn’t use the entire CTCL, so we would actually have some amounts carried forward. The below illustrates how this carry forward is calculated and the inclusion of the yearly CTCL increase.

As we can see, we start with our opening CTCL of $1,000 and reduce this for the CTC claimed of $750, plus our yearly increase in our CTCL of $250. This results in a balance for next year of $500, meaning that we could get $500 of non-refundable tax credits if we claim at least $1,000 ($500 / 50%) of tuition and other fees.

Now let’s look at a situation where the tuition and other fees exceed the CTCL. Assume the same facts as above, but instead the tuition and other fees are $10,000.

In the above we go through a similar process, however, because the CTC is limited to the CTCL we then transfer the amount that can’t be CTC to the tuition tax credit. Effectively, our amounts are the maximum limit for CTC, per the CTCL, of $1,000, and the remainder goes to the tuition tax credit. You’ll notice that the credit rate goes down from the previous example, which is because the amount that can be claimed at 100% also went down. Still a reasonable credit.

Let’s also look at how this would impact the CTCL for the following year.

As we can see, the CTCL is still decreased by the actual amount of CTC claimed in the year. This demonstrates that this limiting factor cannot go below zero, as the CTCL controls the amount of CTC claimed.

A final consideration is the refundable tax credit portion of the CTC. As was discussed briefly in our Basic Personal Amount blog post and then discussed again in our Canada Workers Benefit blog post, refundable credits are paid out regardless of whether there is any taxes payable.

To illustrate this, let’s assume that we have taxes payable, after all other credits such as the basic personal amount, of $1,500. Let’s assume we have the same facts as above and we will determine the amount of taxes payable or refundable in this situation.

In the above we note that even after the tuition tax credit there is still $150 of taxes payable. We then apply this against the CTC to reduce the CTC to $850. This $850 is still a refund, meaning that despite there being no taxes payable left you still get the $850. This is the value of a refundable tax credit, they still pay you even if there are no taxes payable left.

Important Considerations

It is important to note that you do not necessarily need to claim the tuition tax credits in a year if you want to claim the CTC. Instead, you will simply need to indicate that you want to claim the CTC, which will then reduce your tuition tax credits for the amount of the CTC claim, and then you can decide what you want to do with the tuition tax credits.

Consider a situation where an individual has no income but has $10,000 of tuition and other fees. They have a CTCL for the year of $1,000.

The tuition and other fees were reduced to $9,000 and then we noted we didn’t want to claim these, so they are set to $0, whereas the CTC remains at $1,000 as we opt to claim the full amount. Both are then applied at their applicable rate, with $0 for the tuition tax credit, as we didn’t claim any amounts and the full $1,000 for the CTC.

Given this, we can see that even if you have no income in a year you can still benefit from the refundable portion of the CTC, giving you $1,000 back in a time when it is most needed. It is therefore crucial that you understand what your CTCL is and claim this amount in the years it is most valuable and available to you. To assist with this, we would recommend you discuss this with a tax professional.

How to Claim the Tuition Tax Credit and Canada Training Credit

Claiming the tuition credit involves these simple steps:

Obtain form T2202 Tuition and Enrolment Certificate from your educational institution.

Report your eligible tuition fees on Schedule 11 Federal Tuition, Education, and Textbook Training Amounts and Canada Training Credit of your tax return.

Keep your T2202 certificates and receipts as documentation for possible CRA review.

How to Maximize Your Tuition Tax Credit

Consider these strategic actions:

Clearly track all tuition payments and ensure your institution provides Form T2202 each year.

Plan carefully around when to use or transfer tuition credits, depending on current and expected future income levels.

Evaluate the benefits of transferring unused credits to a spouse or parent to achieve immediate tax savings.

Common Mistakes and How to Avoid Them

Common mistakes taxpayers make when claiming tuition credits include:

Forgetting to report eligible tuition fees.

Not claiming or incorrectly transferring unused tuition credits.

Failing to maintain proper documentation (Form T2202).

Not indicating you want to claim the CTC.

To avoid these mistakes:

Verify your eligibility for tuition credits carefully.

Keep meticulous records, including T2202 certificates and payment receipts.

Strategically plan credit transfers based on family members' incomes.

Review your return carefully to ensure that the CTC is claimed if you want to receive this.

Impact on Other Benefits and Credits

Claiming tuition tax credits reduces taxes payable, potentially increasing your eligibility for income-tested benefits, including the GST/HST credit or the Canada Child Benefit.

Summary

The Tuition Tax Credit and Canada Training Credit provides valuable financial support for students and families facing the costs of post-secondary education. Understanding eligibility, properly documenting expenses, and strategically managing tuition credits can significantly enhance your tax savings.

Stay tuned for our next blog, where we'll explore medical expenses and how to effectively utilize medical expense credits.

KLV Accounting, a Calgary-based accounting firm, is here to help. Contact us today to enhance your financial strategy, minimize your taxes, and drive business success! For a free consultation, call us at 403-679-3772 or email us at info@klvaccounting.ca.

Next blog - Upcoming! |

.png)

Comments