Financial Statement Series: What is the Cash Flow Statement and Why Should you Care?

- Rylan Kaliel

- Jul 11, 2025

- 5 min read

In this blog we will learn about what a cash flow statement is and why it is important for you to understand it and utilize it in your business.

What Is a Cash Flow Statement?

In the previous blogs we learned about what the Balance Sheet and Income Statement are and how they help you learn more about how your business is doing. The Cash Flow Statement is derived from the numbers that make up the aforementioned statements and its main use is to understand the cash flows of your business. A Cash Flow Statement is a financial document that tracks the movement of cash into and out of a business or individual’s accounts over a specified period. It provides a clear snapshot of liquidity, showing whether a business has enough cash to operate effectively. For example, a small coffee shop might use a Cash Flow Statement to track money earned from coffee and pastry sales (inflows) and money spent on rent, utilities, and employee salaries (outflows). In this case the owner of the coffee shop can see if the cash coming in from selling the coffee will cover all the immediate expenses that need to be paid out to keep it running.

The Cash Flow Statement is divided into three main sections: operating activities, investing activities, and financing activities:

Operating Activities: Cash generated or spent in the day-to-day operations, such as sales revenue, utility payments, and wages.

Investing Activities: Cash used for purchasing or selling assets, like equipment, vehicles, or property.

Financing Activities: Cash obtained from or repaid to investors, lenders, or shareholders, including loans, dividends, and stock issuance.

In the next segment we will look at what are the unique characteristics of a Cash Flow Statement that makes it a useful analytical tool.

Characteristics of a Cash Flow Statement

The Cash Flow Statement has several defining characteristics that make it essential for financial analysis:

1. Real-time Representation

Unlike the Balance Sheet and Income Statement, the Cash Flow Statement shows the actual movement of money. This allows you to make business decisions based on the cash standing of your business rather than based on the sales figures from the income statement that would show you what you have earned but not the money that you have received from it. You might have a million-dollar worth of sales in a month but only received $200k of it in that month, therefore any spending decisions you make in that month needs to be based on the money you have not the money you will have in the future.

2. Categorization of Activities

Transactions are split into operating, investing, and financing activities, offering a structured view of where cash is coming from and where it’s being spent. Which helps you better understand your immediate situation and to make better decisions in the future.

3. Highlights Cash Surpluses and Shortfalls

It identifies periods of positive cash flow (more inflows than outflows) and negative cash flow (more outflows than inflows), enabling better financial planning.

4. Connection to Financial Statements

The Cash Flow Statement complements the Income Statement and Balance Sheet, providing a holistic view of financial health.

How to Prepare a Cash Flow Statement

Creating a Cash Flow Statement is straightforward, even for non-accountants. Here’s a step-by-step guide:

Step 1: Identify Cash Transactions

Begin by identifying all cash inflows and outflows during the reporting period. For a home-based bakery, inflows might include sales revenue, while outflows could involve ingredient purchases and packaging costs.

Step 2: Categorize Transactions

Group these transactions into operating, investing, and financing activities. For example, rent payments would fall under operating activities, while purchasing an oven would be an investing activity.

Step 3: Calculate Net Cash Flow

Subtract outflows from inflows for each category. This will give you a clear picture of cash gained or lost in operating, investing, and financing activities.

Step 4: Use Tools for Accuracy

Utilize spreadsheets or free software to track and calculate cash flow efficiently. These tools can help automate calculations and organize data.

Details on Operating, Investing, and Financing Activities

Operating Activities

The operating activities section focuses on the core business operations and reflects cash generated or spent in the day-to-day running of the business. It includes:

Cash Inflows: Revenue from sales of goods and services, receipts from customers, and refunds received.

Cash Outflows: Payments for supplies, employee wages, rent, utility bills, administrative expenses, and taxes.

Please keep in mind that you don’t want to include any noncash expense such as depreciation, amortization or contingent liabilities in the Cash Flow Statement as they don’t impact cash.

Investing Activities

The investing activities section highlights the cash flow related to the acquisition and disposal of long-term assets and other investments. It includes:

Cash Inflows: Proceeds from selling equipment, property, or investments and repayments on loans given to others.

Cash Outflows: Purchases of equipment, property, or vehicles, as well as payments made for acquiring other investments or businesses.

For instance, a bakery might report outflows for purchasing a new oven and inflows from selling an old delivery van.

Financing Activities

The financing activities section deals with cash movements between the business and its investors or creditors. It includes:

Cash Inflows: Proceeds from issuing shares, taking on loans, or receiving capital contributions.

Cash Outflows: Repayment of loans, payment of dividends to shareholders, and repurchase of company stock.

For example, a startup might report inflows from investor funding and outflows for paying back a portion of its business loan.

Methods for Creating a Cash Flow Statement

There are two primary methods for creating a cash flow statement:

1. Direct Method

The direct method records cash inflows and outflows exactly as they occur. For example, a freelance writer might list payments received from clients and expenses like internet bills and software subscriptions.

2. Indirect Method

The indirect method starts with net income from the Income Statement and adjusts for non-cash items (like depreciation) and changes in working capital. While more technical, this approach ensures the Cash Flow Statement aligns with other financial records.

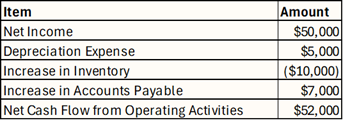

Example: Indirect Method for a Clothing Store

Imagine a small clothing shop records net income of $50,000 for the year. The adjustments for non-cash items and changes in working capital might include:

The indirect method adjusts the net income to reflect actual cash movements, providing a clearer picture of liquidity.

Examples of Cash Flow Statements

Example 1: A Freelance Graphic Designer

A freelance designer earns $5,000 from client projects but spends $2,000 on software, marketing, and co-working space fees. The Cash Flow Statement would break this down as follows:

Example 2: A Home-Based Bakery

A bakery earns $2,000 from cake sales but spends $1,500 on ingredients, packaging, and delivery services. Its Cash Flow Statement might look like this:

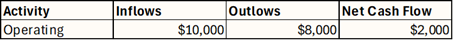

Example 3: A Seasonal Business

A holiday decoration shop earns $10,000 in December but spends $8,000 on inventory and advertising. The Cash Flow Statement would show:

Conclusion

A Cash Flow Statement is an invaluable tool for tracking financial health, ensuring liquidity, and making informed decisions. By understanding its structure, preparing one with accessible methods you can gain a better understanding of your business and its cash needs in the short term as well as helping you plan.

In the next blog we will discuss unique liabilities, what they are, and how to deal with them.

KLV Accounting, a Calgary-based accounting firm, is here to help. Contact us today to enhance your financial strategy, minimize your taxes, and drive business success! For a free consultation, call us at 403-679-3772 or email us at info@klvaccounting.ca.

Next blog - Upcoming! |

.png)

Comments